News

City exempts nonprofit veteran organizations from 2% hospitality tax

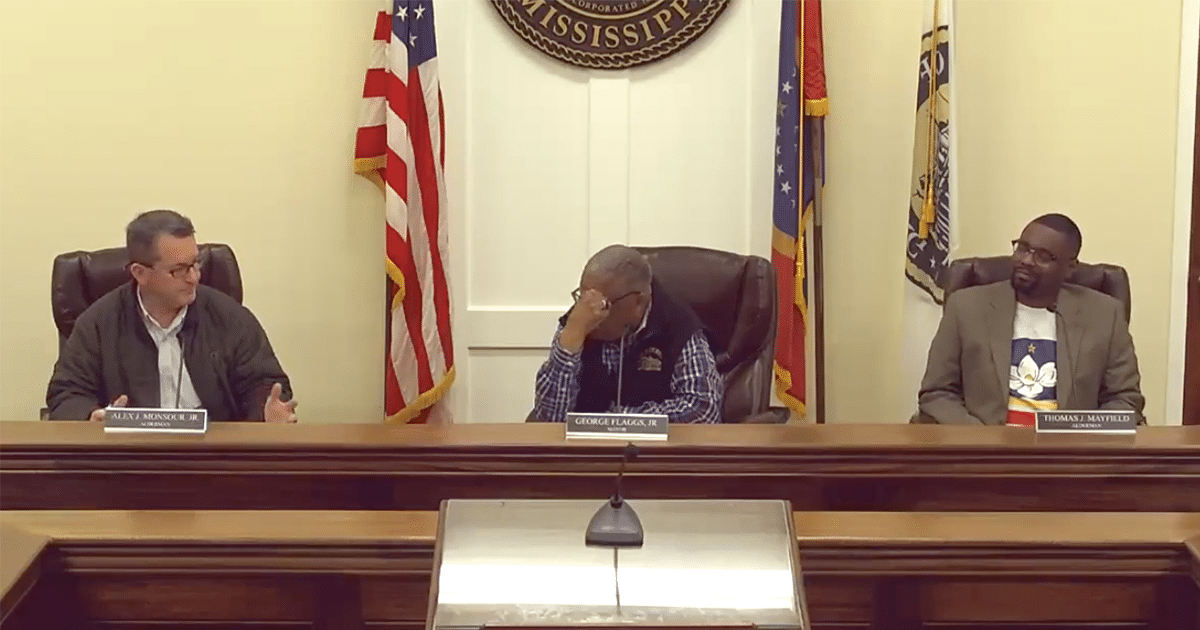

VICKSBURG, Miss. (VDN) — The city of Vicksburg has adopted a resolution to exempt nonprofit veteran organizations from the 2% sales tax, commonly referred to as the “hospitality tax,” following a special-called meeting of the Mayor and Board of Aldermen on Tuesday. The resolution takes effect immediately.

Senate Bill 2926, passed in 2015, revised a 1995 bill that had a repeal date of Sept. 30, 2017. The bill levies an additional 2% sales tax on all restaurants and hotels operating within city limits, with the revenue directed toward recreation and tourism facilities.

In a notice to taxpayers issued by the Mississippi Department of Revenue on Aug. 28, 2017, the definition of a restaurant is broad. “For purposes of this levy, the term ‘restaurant’ means all places where prepared food and beverages are sold for consumption, whether such food is consumed on the premises or not.”

Since no exemption clause was specifically written into the original bill, nonprofit veteran organizations who occasionally host events where food and beverages are sold, fall under the definition of ‘restaurant’ and have been paying the tax.

“It costs them [nonprofit veteran organizations] almost a thousand dollars to file the paperwork properly, and the total tax is around $200, is what is brought in off that. It’s just time to help them out, so we are doing it today,” said Alderman Alex Monsour in the meeting.

Below is the language from the resolution exempting non-profit Veteran organizations.

“WHEREAS, the Board of Mayor and Aldermen of the City of Vicksburg, Mississippi, shall exempt non-profit Veteran organizations, including but not limited to local VFWs, American Legions, Tyner-Ford American Legion Post #3, American Legion Post 3, and Army Navy Clubs from a levy of tourism and hotel tax upon the gross proceeds derived from the sale of prepared foods, beverages, or restaurant foods by the organizations in the City of Vicksburg.”

See a typo? Report it here.